Have you been aspiring of owning your perfect home? A private home loan could be the key to manifesting your dream. These loans offer flexible terms and rapid approval processes, making them a attractive option for many homeowners. Whether you're searching to purchase a charming property or renovate your existing one, a private home loan can provide the funding you need to make your vision a reality.

- Private loans often have minimal stringent requirements than conventional mortgages.

- Benefit from faster approval times and quicker closing processes.

- Consider a wider range of loan options, including those for specialty properties.

Secure Private Home Mortgage in Australia

Securing a private home financing solution in Australia can be a complex process, requiring careful consideration of various elements. To ensure your financial well-being and peace of mind, it's essential to work with reputable lenders and advisors who understand the nuances of this type of agreement.

A sound private home financing strategy should encompass a thorough analysis of your financial situation, including income, expenses, and credit history. Additionally, it's crucial to research different loan options, interest rates, and repayment terms to determine the most suitable solution for your requirements.

Before committing to any financing agreement, ensure you understand all the conditions. It's always advisable to seek professional advice from a qualified financial advisor who can provide personalized insights tailored to your specific situation.

Obtain Private Home Loans for Bad Credit: Get Approved Today

Do you have bad credit and want a new home? Don't let go of hope! Private home loans are a fantastic option for borrowers with less-than-perfect credit. These loans provide flexible conditions and higher approval rates than traditional mortgages.

Regardless of your past financial history, you may still be able to become eligible for a private home loan. Our knowledgeable team will work with you to discover the best loan solution to suit your individual needs.

Submit today and take the first step toward owning your dream home!

Need Non-Bank Private Home Loans: Fast & Flexible Solutions

In today's fast-paced real estate environment, getting a home loan can often feel like a lengthy and complex process. Traditional banks may have {strict{ requirements and lengthy approval times, leaving many borrowers feeling discouraged. However, there's an alternative: Non-Bank Private Home Loans. These innovative lending solutions offer a efficient application process and adjustable Non Bank Private Home Loan terms that align the needs of a wider range of borrowers.

One of the most appealing advantages of Non-Bank Private Home Loans is their speed. With accelerated paperwork and faster decision-making, you can often secure funding in a short amount of time, getting you closer to your dream home sooner. Moreover, Non-Bank lenders are known for their accommodation. They often have more {lenient{ requirements and are willing to evaluate borrowers who may not qualify for conventional financing.

- Discover Non-Bank Private Home Loans today and see how they can help you achieve your homeownership goals faster and easier.

Navigate the Property Market with a Private Home Loan

Purchasing a home can be a daunting process. In spite of the current market conditions, there are always opportunities to secure financing. A private home loan might be a great solution for individuals seeking. These loans are commonly offered by private lenders, and they can provide greater flexibility that may not be offered through conventional lending channels.

Think about a private home loan if you:

* Are looking for quicker approval process.

* Want non-traditional terms which.

* Have unconventional financial circumstances that are sometimes accepted by conventional lenders.

A private home loan can help you navigate the nuances within the property market and realize your goal of owning a home.

Bridging the Gap: Private Home Loans for Unique Situations

Navigating the traditional mortgage market can be a daunting experience, especially when facing special financial situations. Traditional lenders often operate within strict parameters, frequently leaving borrowers with limited options. However, private home loans offer a adaptable approach for individuals seeking funding for specialized property needs.

These loans are evaluated by private lenders, who often have a higher willingness to review individual circumstances. This can be particularly advantageous for borrowers with complex financial histories, alternative revenue streams, or homes requiring specialized financing.

Assuming you are a self-employed individual, have a significant down payment, or are looking to finance a property with distinct characteristics, private home loans can provide the funds you need to attain your real estate goals.

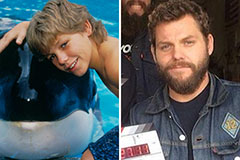

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!